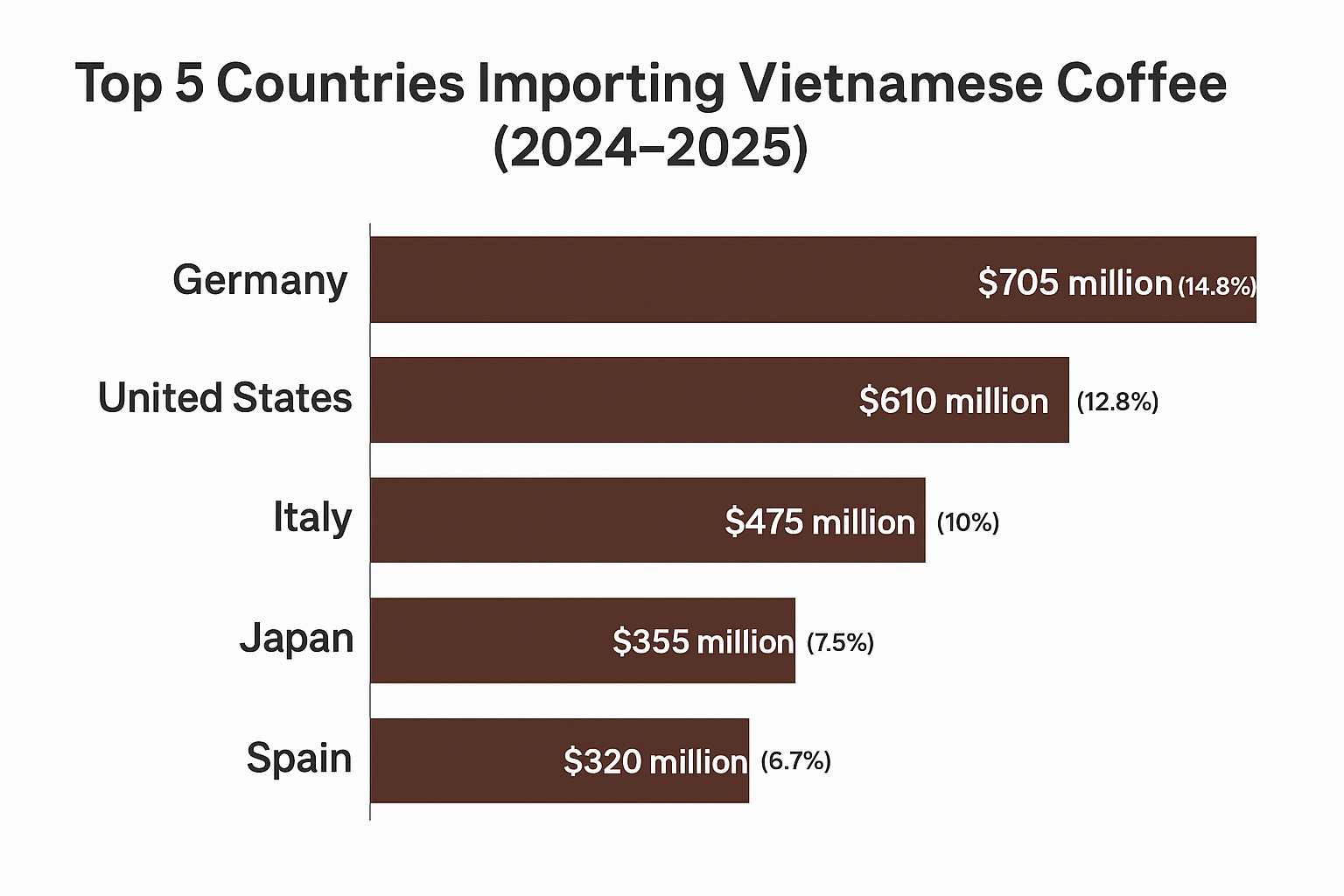

Vietnam has consolidated its position as the world’s second-largest coffee exporter and the leading supplier of robusta, accounting for more than 40% of global robusta output in several recent crop years. During 2024–2025, export revenue reached approximately USD 5.0–5.6 billion, driven by rising global demand for robusta, higher export prices, and growth in value-added products.

Understanding where Vietnam’s coffee flows — and why — is essential for international roasters, traders, and distributors seeking reliable long-term supply. Below is a deep-dive analysis of the five countries that import the most Vietnamese coffee today, based on multi-source trade data and market behavior across the EU, North America, and Asia.

1. Germany

Estimated annual import value: USD ~705 million

Germany stands as Vietnam’s largest export destination not merely due to consumption, but because it functions as Europe’s primary roasting and re-export center. Major German roasters source large volumes of Vietnamese robusta to support a production system built on consistency, standardized cupping profiles, and high-volume throughput.

Why Germany is number one:

- Industrial-scale demand: Germany runs some of the world’s highest-capacity roasting facilities, making volume reliability a top priority — a strength Vietnam delivers consistently.

- Preference for robusta-based blends: Large consumer brands in Central Europe rely on robusta to supply supermarket shelves at competitive price points.

- Strategic re-export role: A significant portion of roasted and soluble coffee processed in Germany is distributed onward across the EU.

- Compliance alignment: Vietnamese exporters have increasingly met EU sustainability and traceability requirements, reinforcing trust in long-term contracts.

Implication for exporters: Buyers in Germany expect not just quality beans, but documentation accuracy, sustainability reporting, and stable multi-container supply contracts.

2. United States

Estimated annual import value: USD ~610 million

The U.S. has undergone a structural shift in its coffee landscape. While it is traditionally an arabica-heavy market, consumption is moving toward:

- espresso blends requiring robusta,

- RTD (ready-to-drink) beverages,

- instant coffee, and

- functional coffee products.

These categories have sharply increased the demand for Vietnam’s robusta and value-added derivatives.

Key market drivers:

- Cost efficiency vs. arabica: Rising arabica prices have pushed U.S. roasters to rebalance blends using high-quality robusta.

- Booming RTD and instant segments: Major beverage companies rely on Vietnamese inputs due to flavor stability and large-scale availability.

- Demand for consistent sensory profiles: Vietnam’s robusta offers predictable roast behavior, essential for nationwide retail brands.

- Regulatory framework: Compliance with FDA, FSMA, and pesticide-residue standards is strict but manageable with established Vietnamese exporters.

Implication for exporters: U.S. buyers are opportunity-rich but expect technical specifications, contamination control, full COA documentation, and repeatable flavor profiles.

3. Italy

Estimated annual import value: USD ~475 million

Italy’s espresso culture depends on crema, body, and blend stability, all of which robusta supports more effectively than arabica alone. For decades, Italian roasters — from heritage brands to mid-size specialty roasters — have integrated Vietnamese robusta for both flavor and cost reasons.

Why Italy continues to rely on Vietnam:

- Crema production: Robusta contributes significantly to the crema layer expected in Italian espresso.

- Blend structure: Many “classic Italian espresso” blends use 20–40% robusta.

- Sustained roasting tradition: Italy remains one of Europe’s largest roasting markets per capita.

- Growing interest in certified origins: Italian roasters increasingly ask for traceability, sustainability seals, and micro-lot differentiation.

Implication for exporters: Italy values consistent roasting behavior, moisture uniformity, and reliable bean grading over marketing narratives.

4. Japan

Estimated annual import value: USD ~355 million

Japan is a benchmark for quality-focused sourcing. Vietnamese coffee fits this market through improvements in post-harvest processing, defect reduction, and traceability systems.

Japan is also one of the world’s largest markets for premium instant coffee and canned RTD, industries that rely heavily on Vietnamese raw materials.

Core reasons for strong import demand:

- Emphasis on cleanliness: Japanese buyers scrutinize foreign matter, mold risk, water activity (aW), and pesticide residues more strictly than almost any market.

- Demand for stable flavor profiles: RTD and instant manufacturers require uniformity, which Vietnam’s large production clusters support.

- Long-term contract culture: Japanese companies favor multi-year relationships with reliable exporters who maintain strict QC protocols.

- Growth of specialty robusta: There is a rising niche market for higher-grade Vietnamese robusta among Japanese boutique roasters.

Implication for exporters: To succeed in Japan, exporters must deliver precision QC, lab reliability, and batch-to-batch consistency — not just good beans.

5. Spain

Estimated annual import value: USD ~320 million

Spain’s coffee consumption has grown steadily, fueled by hospitality, home espresso machines, and private-label supermarket brands. Spanish roasters rely on robusta-rich blends that balance taste, crema, and affordability — making Vietnam a natural partner.

Market characteristics:

- Price-sensitive but quality-aware: Spanish buyers seek high-quality robusta but maintain strong focus on cost efficiency.

- Rising roasting capacity: Domestic roasting growth increases import needs from Vietnam.

- Strategic logistics access: Spain serves as a distribution node for Southern Europe, North Africa, and parts of Latin America.

- Wide supermarket penetration: Private-label brands in Spain use Vietnamese robusta for consistent mass-market blends.

Implication for exporters: Spain is ideal for exporters offering competitive pricing, reliable logistics, and scalable volume.

Read more: Top 10 Vietnamese Coffee Suppliers for International Buyers

Global Insights: What These Five Markets Reveal About Vietnamese Coffee

Across Germany, the U.S., Italy, Japan, and Spain, a clear pattern emerges:

1. Robusta demand is structurally rising worldwide

Vietnam’s large-scale, stable robusta production aligns perfectly with the global shift toward espresso blends, instant coffee, and RTD beverages.

2. Traceability and sustainability are no longer optional

The EU’s new regulations, Japan’s strict QC systems, and the U.S. compliance requirements mean exporters must deliver documentation, certifications, and transparent supply chains.

Vietnam is no longer only a green-bean supplier; major growth is coming from:

- roasted coffee,

- soluble coffee,

- coffee extracts, and

- OEM/private-label production.

4. Buyers are prioritizing consistency and reliability

Markets now expect year-round supply, predictable cupping profiles, and robust quality-control systems — areas where professional Vietnamese exporters excel.

Across Europe, North America, and Asia, Vietnam’s coffee has become a strategic product for both industrial and specialty markets. Germany, the United States, Italy, Japan, and Spain lead global import demand, each driven by distinct consumption patterns and industry structures.

For international partners, working with a trusted Vietnamese supplier ensures not only stable access to high-quality robusta and processed coffee products, but also alignment with sustainability, compliance, and long-term supply security.